Updated 5th February 2026

Welcome to my website

I am a UK based private investor interested in the art of stock picking. The aim of the site is to share some thoughts on stock selection and compile a list of resources for those of you who wish to build a portfolio. Whether investing for your pension, trying to earn a better return on savings or perhaps have loftier ambitions as part of the ‘FIRE’ movement, I hope that it will provide some food for thought.

At this point I should point out that I am not an investment advisor – so you should not make any investment decisions based purely on these pages.

Thanks for stopping by and good luck investing!

My stock picking strategy

I’ve dabbled in the stock market since the early 2000s – buying shares on an ad-hoc basis – however during May 2017 I decided to start building a portfolio in a more structured way.

To decide which shares should be in the portfolio I begin by creating two shortlists. The first shortlist aims to highlight good companies that are attractively priced. Good in the sense they generate a high return on the capital employed, and attractively priced in terms of the company’s earnings relative to the cost of acquiring the business (adjusting for cash and debt levels). By ranking the companies by these two measures and then adding the rankings together it is possible to identify those which have a favourable ranking for both. This approach is inspired by Joel Greenblatt’s book ‘The Little Book that Beats the Market’.

The aim of the second shortlist is to find companies which are likely to provide sustainable dividend income. The dividend yield percentage can be found easily on many financial websites, but to measure sustainability I consider how many times the company earnings cover the dividend payments to shareholders. Again, a double ranking approach can be used to find shares which are relatively strong on both fronts.

After compiling the shortlists, I then try and figure out how to include companies from a range of different sectors and from both the FTSE100 (the largest companies on the London Stock Exchange) and the FTSE250 (the next tranche of companies). Hopefully any red flags can be spotted at this stage too – is the level of debt a cause for concern; are the financial results outliers or part of a trend that’s likely to continue?

Finally, there is normally room in the portfolio for a few wildcard selections. These are based on personal experience of the company’s products or services and are included if I feel good about the direction of the company and the price point of the shares.

The performance of the portfolio over time

This table shows the total return of the portfolio by year (including dividends), along with the FTSE100 and FTSE250 total returns. Notice the variability of returns from one year to another, this is to be expected when investing in the stock market.

| YEAR | TOTAL RETURN | FTSE100 T.R. | FTSE250 T.R. |

|---|---|---|---|

| 2017* View holdings | 11.5% | 4.9% | 6.5% |

| 2018 View holdings | -10.9% | -8.7% | -13.3% |

| 2019 View holdings | 29.1% | 17.3% | 28.9% |

| 2020 View holdings | -6.0% | -11.5% | -4.6% |

| 2021 View holdings | 22.8% | 18.4% | 16.9% |

| 2022 View holdings | -8.1% | 4.7% | -17.4% |

| 2023 View holdings | 10.2% | 7.9% | 8.0% |

| 2024 View holdings | 14.6% | 9.7% | 8.1% |

| 2025 View holdings | 30.4% | 25.8% | 13.0% |

| 2026 View holdings | |||

| Average per year | 10.4% | 7.6% | 5.1% |

*2017 figures commence mid-May.

A short guide to buying and selling shares

Opening a share dealing account is like opening a bank account – in fact many banks offer this service and allow you to transfer funds from your existing account. If eligible to do so, an Individual Savings Account (ISA) can be used to provide relief from tax (otherwise any gains realised on selling the shares may be liable to capital gains tax, with dividends being liable to income tax). Some accounts have an administrative charge payable on a monthly or annual basis.

There are various transaction charges payable when buying or selling shares such as commission, stamp duty and PTM levy, these should be detailed to you before the shares are purchased or sold.

The share price you will be quoted will be slightly less favourable than the market price – this is because there is a spread between the buying and selling prices to enable the market to function. Generally, the larger the company the smaller the difference between buying and selling prices. Be sure to select the correct company name when purchasing shares, usually it’s possible to enter the ticker code instead of typing the full company name (for example ULVR for Unilever). After the transaction has been completed a contract note (confirmation of the trade) will be issued and should be retained for future reference and tax records.

Keep in mind that dividend-paying shares will go ‘ex-dividend’ a short while before the dividend payment date. Investors who purchase the stock from this date onwards will no longer be entitled to that specific dividend payment and in the absence of other factors the share price would be expected to fall by the equivalent amount.

Resources to help with investing

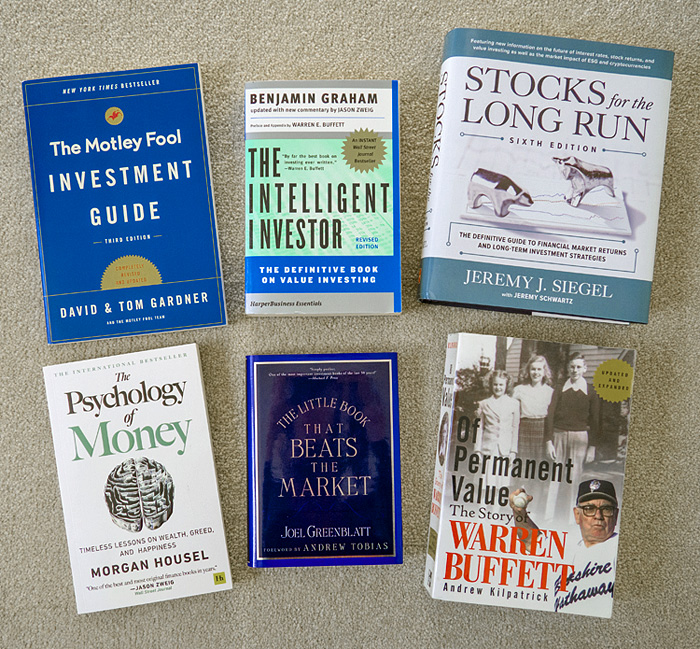

Some of the books I've read to learn about investing in the stock market

Most of the following reference the US stock market, generally the material is useful when considering investing in the UK market too.

► The Motley Fool Investment Guide by David & Tom Gardner - this is a good book for those starting out as it should provide a grounding in various approaches to investing and is written in a style that’s easy to understand.

► The Intelligent Investor by Benjamin Graham – first published in 1949, this is often regarded as the best investment book ever written. The edition I have has commentary at the end of each chapter which relates the material to the present day. I found the chapter on margin of safety particularly useful.

► Stocks for the Long Run by Jeremy Siegel (sixth edition) - a large book which covers a vast number of topics, supported by graphs and tables throughout. The first edition was published in 1994, this edition includes significant items from the intervening 28 years such as the technology bubble, 2008 financial crisis and the impact of the Covid-19 pandemic. There is a lot to absorb but each chapter has a brief conclusion summarising the key points.

► The Psychology of Money by Morgan Housel – temperament is a big part of investing and I feel this book does a superb job at highlighting how behavioural factors play a role.

► The Little Book that Beats the Market by Joel Greenblatt – I first read this book shortly after publication in 2005 and its core principle remains a key part of my stock picking strategy. It is an entertaining read too.

► Of Permanent Value: The Story of Warren Buffett by Andrew Kilpatrick. At over a thousand pages, this is a comprehensive account of Warren Buffett’s investing career up to the publication year of 2001. It includes chapters on specific investments such as Geico, Coca-Cola and Gillette as well as plenty of anecdotes.

► The Economist – a weekly magazine which includes current affairs items and interesting articles about business, culture, technology and politics.

► The Motley Fool Money podcast – this has a US focus but many of the topics they discuss apply both sides of the Atlantic.

► The Bottom Line podcast – round table discussion about issues affecting the world of business.

► ADVFN – branded as the home of the private investor, this site includes plenty of information and the share chat section has some interesting posts.

► Yahoo Finance – useful website for checking share price graphs and company financial data.

► The London Stock Exchange – the regulatory news service is where you should go to find company announcements. The fundamentals section for individual equities is invaluable too.

► dividenddata.co.uk – a great resource for monitoring dividend yields and payment dates.